By Aritra Banerjee

During this year’s Navy Day Press Conference held on 3 December 2022, the Chief of Naval Staff Admiral R Hari Kumar confirmed that the Indian Navy is on the hunt for Unmanned Underwater Vehicles (UUVs). It has already shared its requirements with the defence industry. The Indian Navy will likely import underwater drones until indigenous solutions are operational.

Gaining Underwater Domain Awareness (UDA) is mission critical and had been highlighted as a key priority area by former Indian Navy Chief Admiral Karambir Singh during the Navy Day press conference in December 2020. The Navy has since laid out its ‘Unmanned Roadmap’ to bolster its unmanned technology and systems capabilities. It revealed an unclassified version of its ‘unmanned capability roadmap’ during its Swavlamban 2022 seminar held between 19-19 July 2022. Defence Minister Rajnath Singh released the Integrated Unmanned Roadmap for the Indian Navy in October during this year’s Naval Commander’s Conference.

The Indian Navy needs Unmanned Combat Aerial Vehicles (UCAVs) and UUVs to carry out various underwater operations ranging from maritime surveillance to combat. Commonly known as underwater drones, UUVs come in two broad categories: Remotely Operated Underwater Vehicles (ROUVs) and Autonomous Underwater Vehicles (AUVs). ROUVs, as the name suggests, are remotely operated by a human, while AUVs operate without human intervention.

UUVs have recently featured in the naval arms race between India and China. New Delhi is seen as trailing behind its main geopolitical adversary, Beijing, in the development of UUV technology at a time when it has been deploying them to further its strategic interests and when the UUV sector is forecasted to show significant growth globally and in the Asia Pacific (APAC). Chinese-origin autonomous underwater gliders were discovered in the waters of Indonesia and the Indian Ocean; this was seen as alarming instances of how far China is when deploying UUVs.

Why UUVs?

Veteran Indian Naval submariner Commodore Anil Jai Singh (r), who is presently the Vice President Indian Maritime Foundation notes that “UUVs offer navies flexibility, advanced technology, lower implementation and operational costs and improved operational time and safety. Amongst the many security related tasks that UUVs are being configured for, the salient ones are mine warfare, critical infrastructure protection, choke point monitoring, anti-submarine warfare (ASW) and anti-surface warfare (ASuW), intelligence surveillance reconnaissance (ISR), search and rescue (SAR), harbour and coastal surveillance, oceanographic research and bathymetric data collection and processing.” Furthermore, manned-unmanned teaming is seen by some insiders as the future of naval operations. However, it needs to be ensured that these drones are compatible with the Indian Navy’s existing manned platforms.

The Navy’s Wishlist

It has been learnt that there are four primary technologies which the Indian Navy is looking for as part of its UUV requirements.

One such technological need is the Man-Portable AUVs. These underwater drones should be capable of swarm functionality and have a minimum endurance of 10-20 hours. Another naval requirement is for Light-Weight AUVs, with at least 48 hours of endurance, compatible with the Indian Navy’s torpedo tubes. Heavyweight AUVs with minimum endurance range between 72-84 hours and compatibility with existing heavyweight torpedo is also something the Navy is eyeing. Lastly, the Indian Navy is also looking for High-Endurance AUVs capable of remaining submerged for at least 15 days. These are areas where the defence industry could offer solutions.

Indigenous UUV Offerings

India’s UUV efforts are still nascent and, according to industry watchers, require a holistic and inclusive approach from all stakeholders. However, despite being in its infancy, Larson and Toubro Defence, Mazagon Shipbuilders Limited (MDL) and the Defence Research and Development Organisation (DRDO) have set the ball rolling for this emerging field in defence technology with their solutions and product offerings.

L&T has showcased Adamya, Amogh, and Maya AUVs at DefExpo 2020. The Indian private sector firm’s offering was reported to be the forerunner of the Indian Navy’s bid to acquire 10 tube-launched AUVs. The L&T Adamya AUV, in particular, can be launched from submarines with 533mm torpedo tubes and is touted to have an operational endurance of over eight hours at four knots and can descend up to 500 meters. The L&T Adamya AUV has a length of five meters and can be submarine-launched without making significant modifications to the submarine. This AUV offering has been described as being able to be launched from surface ships using the launch and recovery system included. Depending on end-user requirements, the L&T Adamya AUVs operating payload and various systems can be customised. L&T recently signed a Memorandum of Understanding (MOU) with the Banglore-based New Space Research and Technology (NRT) to develop UUVs for surveillance purposes.

MDL, too, is making forays into the global UUV market. Vice Admiral Narayan Prasad (r), Chairman and Managing Director of MDL, previously told Indian Aerospace & Defence that the indigenous shipyard is planning to offer AUVs for export. If it pans out, it will put India on the global UUV market map. The XLUUV, in particular, is designed to carry out operational tasks ranging from payload deployment, periodic communications, preprogrammed mission execution, and return to base. Its internal and external cargo capacities are meant to be reconfigurable based on mission-specific requirements. It has been learnt that the spatial advantages achieved permit greater energy capacity through many energy modules that allow for extended loitering periods, often a few months, and is; as a result, a more economical and mission-capable solution than the conventional assortment of UUVs.

DRDO is also contributing to the indigenous UUV development efforts with its Underwater Launched Unmanned Aerial Vehicles (ULUAV). The organisation aims to design and develop critical technologies to launch UAVs from the North Atlantic Treaty Organisation (NATO)-standard torpedo tubes of submerged undersea platforms. These platforms can reportedly be submerged as deep as 50 metres. The UAVs are being designed to be launched from the canister using a pyro cartridge or a similar mechanism catering to launch-ready conditions. OSINT indicates that these canisters have a maximum diameter of 533 mm. The state is determined by the roll and pitch data from the sensor. The ULUAVs mission is controlled according to the mission profile transmitted through a data connection to the control station. Following mission completion, the ULUAV is expected to use a single-point recovery mechanism to return onboard or to a partner platform. The Indian Navy will use ULUAVs for ISR missions, particularly real-time target tracking, beach reconnaissance, before special operations by the Indian Navy’s elite Marine Commandos (MARCOS) and bolster Maritime Domain Awareness (MDA). These ULUAVs will be outfitted with ISR payloads, sensors and algorithms designed to enhance their operational capabilities. The ground station would be crucial in transferring relevant information between the sub and the surface. Upon mission completion, the ULUAV would need to extract to safety by either landing on the partner platform using the one-point recovery method or using a flotation bag. The DRDO has also developed fish-shaped UUVs, which are preprogrammed with algorithms and mission requirements; however, the progress and approach need to be expedited.

UUV Needs & Capabilities Explored

While the Indian Navy is looking for domestic solutions, it will likely depend on UUV imports to meet its immediate operational requirements. Senior Indian naval officers are acutely aware that developing indigenous capabilities will take time, and solutions need to be found in the interim. The operational imperative is to launch AUVs from submarines for reconnaissance and military strikes if the situation calls for it.

One thing is sure, a naval dimension to India’s evolving drone industry has been added. Some naval analysts believe that UUVs will dominate the seas as opposed to nuclear submarines and aircraft carriers, bringing a new layer to the submarine versus aircraft carrier debate.

It has been felt that nations possessing state-of-the-art UUV technologies and adept in their deployment will have the maritime edge over their adversaries. Artificial Intelligence (AI) enabled UUVs are seen as a force to be reckoned with in 21st-century naval operations. Autonomous navigation systems and advancements in Machine Learning (ML) are likely to bolster the overall development of UUV platforms.

UUV swarms are another critical aspect worth introspection, and the development of operational concepts, positioning, formation control, path planning and mission planning of underwater swarm drones is crucial as these systems become a part of the operating norm. Swarm drones, in general, are a myriad of small, lightweight drones networked together to function like a swarm of bees to cause massive damage to a target. Swarm functionality in the UUV context can lead to critical damage to hostile submarines and aircraft carriers.

Another critical aspect of swarm functionality is the sheer cost-effectiveness. Underwater swarming platforms are far more economical when combatting expensive naval vessels like submarines and surface ships, leading to asymmetric damage in economic terms. Vaibhav Kullashri, anAssistant Professor at the Rashtriya Raksha University, Gandhinagar and visiting fellow at NIICE, Nepal, notes that “UUVs are attuned to other principles of war, like sustainability and economy of effort, which gives them credibility and provides reliable ammunition to the Indian Navy.”

Kullashri believes that size is a crucial factor to keep in mind. The smaller the UUV, the higher levels of lethality it can deliver. The rationale behind this analysis is that a smaller size translates to a minuscule configuration and reduced detection risk. Furthermore, the cost of killing UUVs is seen as more significant when considering their size. In contrast, a UUV swarm can cause unprecedented damage to an adversaries naval fleet in a relatively short amount of time and at a far lower financial cost, at least in theory.

However, particular challenges affect UUVs, like maintaining communications networks and developing longer underwater endurance. The water attenuates the waves at more extended ranges crucial to maintaining communications. Therefore research into quantum communications networks is something that can be delved into. The endurance levels of UUVs are another critical aspect which needs to be addressed. Submerged endurance of over 15 days is necessary for underwater naval operations and surveillance sustainability. This endurance capability is something the Indian Navy needs.

Variable factors like ocean currents, underwater obstacles, large fish, and even fishing nets can affect the outcome of a mission; UUVs need to be equipped with cutting-edge guidance systems, control systems and an onboard brain to gather and decimate relevant data become essential. Apart from the element of surprise, UUVs provide an economy of effort, sustainability, and economic viability, which makes them a credible and reliable option for any modern navy. Leading naval powers are heavily investing in UUV technology, both ROUVs and AUVs in their inventory. The advent of nuclear-powered UUVs is another dynamic addition to the underwater drone matrix.

Global UUV Market: Who Is Leading & Where Is It Headed?

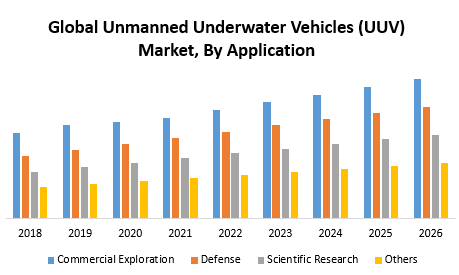

Going by market forecasts, the global unmanned underwater vehicle (UUV) sector stood at around USD 3.9 billion in 2021. The market is further expected to grow at a compound annual growth rate (CAGR) of 14.50% in the forecast period of 2023-2028 to attain a value of USD 8.8 billion by 2027. Fortune Business Insights notes that Asia Pacific (APAC) is expected to witness significant UUV market growth during the forecast period. The growth is attributable to the increasing investments in the defence sector from several countries such as India, China, Japan, South Korea, and others. The countries have increased their defence budgets and procurement of advanced UUVs for naval operations.

In APAC, New Delhi’s geopolitical rival Beijing is leading in UUV developments. In 2018 Lin Yang, the Director of a classified program at the Shenyang Institute of Automation, claimed that China aims to develop AI-driven unmanned underwater robots under its uber-secretive ‘Project 912’. The development is seen as part of China’s geopolitical aims to gain dominance over the South China Sea (SCS) and curb the global United States’ naval stronghold. Analysts like Kullashri believe that China is deceptively innovating and deploying UUVs for civilian objectives but with the underlying aim of gaining a military advantage.

China’s UUV deployments and development came to the fore when Chinese-origin autonomous gliders were discovered in the Indian Ocean and Indonesian waters. The alleged Chinese deployment of UUVs known as the ‘Sea Wing’ (Haiyu) gliders in the Indian Ocean Region (IOR) has enormous strategic and geopolitical implications. Beijing’s perceived deployment of dual-use underwater vehicles offers a two-pronged advantage in the IOR. Firstly, it allows China to monitor trade flow and map out aquatic resources. Secondly, it gives a military edge when required.

The Shenyang Institute of Autonomation, China’s Shipbuilding Industry Cooperation, and the Harbin Engineering University are the three critical drivers of china’s undersea vehicle developments. There are also an emerging number of research institutes and private companies in China’s UUV/AUV markets. The Chinese Society of Naval Architecture published a document in 2019 that lists 159 undersea vehicle research projects under development. The United States of America (USA) is also increasing its funding for autonomous platforms, which is reflected in the 2020 Pentagon budget, and the US Navy has accelerated its UUV acquisition strategies for faster and more streamlined procurement of UUVs in light of the Chinese threat.

India finds itself at a critical juncture in evolving its naval technology and outlook, and analysts feel that the country should move beyond traditional surveillance. China’s deep bed survey capabilities, which it refers to as an ocean battlespace environment, are the projection of its civil-military capabilities. Chinese UUVs have been seen as mapping the worldwide deep-water; Indian capabilities, in contrast, are traditional and need industry innovation and execution to compete in trade and militarily.